Micron Technology (MU) stock surged after the memory-chip giant reported quarterly results that exceeded expectations. The company also provided guidance that surpassed Wall Street forecasts.

The stock saw a significant increase of over 16% in morning trading.

This performance set Micron on course for its best trading day in over a decade. The shares had not seen such a substantial gain in a single session in more than a decade, reaching a 15% increase.

The tech sector as a whole saw a boost, with the Nasdaq Composite registering a less than 1% gain.

Micron shares had closed at $95.77 on Wednesday, marking a 12% increase from the start of the year.

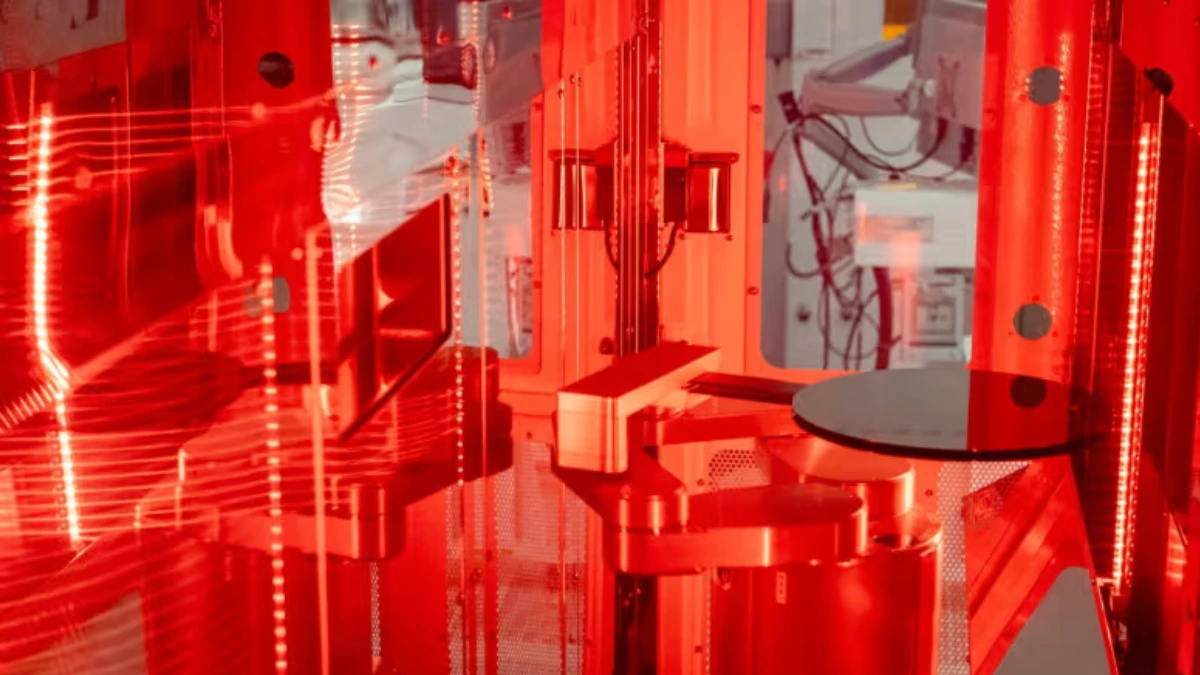

The company highlighted strong demand for chips in data centers, driven by artificial intelligence. This led to a nearly doubling of revenue from the previous year.

Micron predicts continued growth in the next quarter. The company anticipates both revenue and adjusted earnings to surpass analyst projections.

Some key points from Micron’s earnings for its fourth quarter, which concluded in late August:

Revenue reached $7.75 billion, exceeding Wall Street forecasts by about 1.3%, according to FactSet.

Profit surged to $887 million, a stark contrast to the $1.43 billion loss from the previous year.

Adjusted earnings of $1.18 a share outpaced analyst expectations by roughly 6%.

Micron forecasts fiscal first-quarter revenue between $8.5 billion and $8.9 billion. Adjusted per-share earnings are expected to range from $1.66 to $1.82, both figures ahead of analyst estimates.

My name is Jakir, I am a content writer, content creator, I give business, sports, finance, trending news and I have 10 years of experience in this and this is my blog goldennews24.com.